What is budget reporting & why is it important?

A budget management report provides an overview of an organisation’s financial performance and adherence to budgetary goals. The purpose of the report is to help management and stakeholders monitor, analyse and make informed decisions about the organisation’s financial health and resource allocation.

HR, Talent Management, Line Management and Finance all need to collaborate to deliver meaningful outcomes when it comes to headcount and budget management. What is needed is:

- A single source of truth for headcount plans with associated budget information usually from integrating multiple data sources into one place

- Accurate comparisons of budgets against expenditure including historical costs

- Overlay of future positions and recruiting targets

- Understanding of staffing to deliver on business outcomes

- Visibility at team and person level

- Ability to see budget impact of decisions and scenarios

- Ability to securely collaborate, share and review proposed changes across Finance, HR, Talent and Management

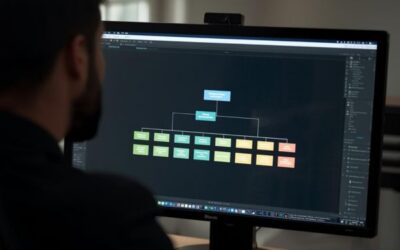

Company budget management chart example

Most people already deal with too many spreadsheets in their day-to-day. When it comes time to allocate budgets and plan out your workforce, why not make it easier on yourself (and maybe even a bit more exciting) by using a visual tool?

org.manager allows companies to organise their key metrics based on org units (departments, cost centres, business units, etc.) and span of control. The visualisation rules highlight departments who are over or under budget, as well as employees that have a compa ratio under 95% of the set benchmark. This chart can also show acting employees and vacant positions that exist now and in the future.

org.manager can also display detailed budgets side-by-side with other departments or compared to previous years. Organisational charts have been utilised by businesses of all sizes for a very long time to show basic hierarchies, so it’s understandably easy to forget that modern org charts can be a useful tool for more than just your company structure.

Tip: This view can be customised based on your business requirements. Use visualisation rules to highlight key information that is important for analysis, or hide fields to reduce the amount of information shown on screen for a more focused view. One example might be ‘show only vacant Manager positions’.

How company budget management software will improve your business

The budget planning process is critical to get right. What is needed is both a top-down view of headcount, costs and budgets as well as a bottom-up plan that needs to address the business priorities. Many of the targets may be ‘moving targets’ until the right mix of factors is landed upon. This can be a significant administrative headache if handled through ad hoc channels such as email, spreadsheets.

Here are 5 ways that company budget management software will help you level up your budget planning process:

Real-time data access: Budget reporting software allows users to access accurate financial data, facilitating quicker and more informed decisions. This agility is essential for adapting to market changes, managing resources effectively and optimising financial strategies.

Data visualisation: A visual representation of financial data makes it easier for stakeholders to understand complex financial information, leading to more informed and timely decision-making.

Key performance indicators (KPIs): Budget reports often allows businesses to track and analyse key performance indicators, providing valuable insights into the financial health of the organisation. This information is crucial for making strategic decisions and adjusting financial plans as needed.

Centralised data source: Budget reporting software often provides a central repository for financial data, fostering collaboration among different departments and teams. This eliminates the need for siloed spreadsheets and encourages a more cohesive and consistent approach to financial planning.

Scenario analysis: Advanced company budget management tools include scenario analysis features, enabling businesses to model different scenarios and assess their potential impact. This helps in creating more accurate and flexible budget plans. Assess the current and future flow-on effects of each crisis management option, showing how each affects the bottom line.

By using dedicated software, you can share your real-time budget report with anyone in your organisation, as well as restrict access to specific fields based on role or user. Our company budget management software is Australian hosted and browser based, making it easy to access and share on any device.

Once you’ve done a review of your finances and have identified what changes need to be made, the next challenge is to update your core HRIS with the relevant details. org.manager’s budget management software allows you to extract a complete change report that can be uploaded back into your HRIS to sync up all the relevant information.

No two budget planning projects are alike, that’s why it’s important to ensure the master data can be extracted in the format and with the relevant information that you need. We are specialists in providing hands on support to develop the right extracts for your HRIS.

What’s next?

Using software for budget reporting can contribute significantly to a business by enhancing financial planning, improving accuracy and compliance, streamlining collaboration, optimising costs and supporting informed decision-making.

Navigo has 20+ years’ experience implementing successful workforce solutions across all industries in Australia. Book a demo today to discover how our portfolio of interactive HR reports will elevate the way you work.